EU Whole-Wheat Flour Market to Hit USD 76.9 Billion by 2035 — Artisan & Health Trends Drive European Expansion

The EU whole-wheat flour market is poised for significant growth, driven by rising health awareness and demand for nutritious bakery products.

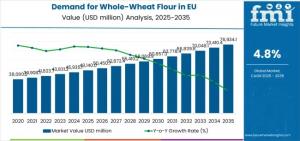

NEWARK, DE, UNITED STATES, November 10, 2025 /EINPresswire.com/ -- The European Union whole-wheat flour market is projected to expand significantly from USD 48,140.0 million in 2025 to approximately USD 76,934.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.8%. This growth represents an absolute market increase of USD 28,513.0 million over the forecast period, supported by accelerating health consciousness, rising demand for whole-grain products, and increasing applications across artisan bakeries, industrial bread production, specialty baked goods, and home baking.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27149

Rising Health Awareness Driving Market Expansion

Consumer preference for nutritionally superior, fiber-rich flour is at the core of market expansion. Whole-wheat flour, known for its digestive health benefits, cardiovascular support, and micronutrient content, is gaining mainstream acceptance across European households and commercial baking operations.

Between 2025 and 2030, the market is projected to grow from USD 48,140.0 million to USD 60,760.3 million, adding USD 12,620.3 million, representing 44.3% of total decade growth. This period will see wider availability of bread, pancake, and specialty flour variants, and growing adoption in retail bakeries and foodservice channels.

From 2030 to 2035, sales are expected to increase to USD 76,653.0 million, adding USD 15,892.7 million or 55.7% of total ten-year growth. The expansion will be fueled by premium artisan bread applications, specialty whole-wheat formulations, and advanced milling technologies preserving nutritional integrity while optimizing baking performance.

Segmental Insights

• By Product Type: Bread flour dominates with 55.0% share in 2025, slightly declining to 53.0% by 2035 as specialty flours like pancake and pizza flour gain traction. Bread flour’s versatility, nutritional benefits, and baking performance secure its leading position across artisan and industrial production.

• By Application: Bread remains the largest application at 32.0% share in 2025, marginally reducing to 31.0% by 2035. Whole-wheat flour supports a range of products from sandwich loaves to specialty artisan breads, emphasizing both health and taste.

• By Distribution Channel: B2B/direct sales dominate at 66.0%, serving commercial bakeries and industrial manufacturers. The channel offers technical support, quality assurance, and bulk delivery, while B2C/retail sales steadily expand.

• By Nature: Conventional whole-wheat flour contributes 88.0% of sales in 2025, declining to 84.0% by 2035 as organic varieties gain momentum, driven by health-conscious and premium consumer segments.

Regional Growth Highlights

• Germany: Largest market with 27.6% share in 2025, CAGR of 4.5%, supported by established bakery heritage and consumer acceptance of whole-grain products.

• France: Fastest growth at 5.2% CAGR, driven by urban health-conscious consumers, organic food trends, and artisan bakery expansion.

• Netherlands: Strong 5.0% CAGR, influenced by exceptional preventive nutrition focus and high organic product adoption.

• Spain: CAGR of 5.1%, fueled by wellness trends and modernizing bakery infrastructure.

• Italy: CAGR of 4.8%, leveraging traditional pasta and artisan bread applications.

• Rest of Europe: CAGR of 4.4%, emerging adoption supported by growing health awareness and modern retail expansion.

Technological and Product Innovations

Advanced milling technologies are transforming production, with precision milling, bran optimization, and enzymatic preservation enabling superior flavor, baking performance, and nutritional integrity. Integration of ancient grains such as spelt, einkorn, and emmer supports premium artisan offerings.

Consumer Transparency & Traceability

European consumers increasingly value traceable wheat sourcing, organic certification, and verified milling processes, leading to greater brand differentiation and trust. Blockchain and supply chain transparency initiatives further enhance consumer confidence in whole-wheat products.

Competitive Landscape

The EU whole-wheat flour market is moderately fragmented with key players including:

• GoodMills Group (12% share): Strong infrastructure, technical expertise, and multi-country operations.

• Groupe Soufflet / InVivo (10%): French bakery networks, vertical integration.

• ADM Milling (9%): Industrial supply chain leadership.

• General Mills – Gold Medal (6%): Retail presence and brand recognition.

• Ardent Mills (4%): Specialty and premium flour offerings.

Other regional millers and organic specialists collectively account for 59% of market share, emphasizing opportunities for niche differentiation.

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27149

Market Drivers and Future Outlook

The EU whole-wheat flour industry is anchored by rising health awareness, expanding artisan bakery sectors, and innovations in milling technologies. Challenges include consumer taste preference for refined flour, price sensitivity, and storage considerations. Nevertheless, growth opportunities remain robust, with demand projected to reach USD 76.9 billion by 2035, highlighting the importance of whole-grain nutrition in European diets.

Browse Related Insights

Whole-Wheat Flour Market: https://www.futuremarketinsights.com/reports/whole-wheat-flour-market

Japan Whole-wheat Flour Market: https://www.futuremarketinsights.com/reports/whole-wheat-flour-industry-analysis-in-japan

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.